Introduction to Trading

How Do I Start Trading Basic to Advanced? Trading is the act of buying and selling financial assets such as stocks, forex, cryptocurrencies, and commodities with the aim of making a profit. It involves predicting price movements and acting upon those predictions by placing orders in the market. The scope of trading can vary from short-term day trading to long-term investing, and each type of trading comes with its own risks and rewards.

Understanding the basics is the first step toward successful trading. Whether you’re a beginner or looking to advance your trading skills, this article will guide you from the basics to more advanced concepts.

Basic Trading Concepts

At its core, trading revolves around the simple concept of buying low and selling high. However, to navigate the complexities of financial markets, you must first understand how buy and sell orders work. Markets function based on supply and demand, with liquidity being a key factor in how quickly you can execute trades.

Market participants range from retail traders to large institutional investors, each playing a role in price movements. As a beginner, you’ll often interact with these participants indirectly via exchanges, which act as intermediaries facilitating trades.

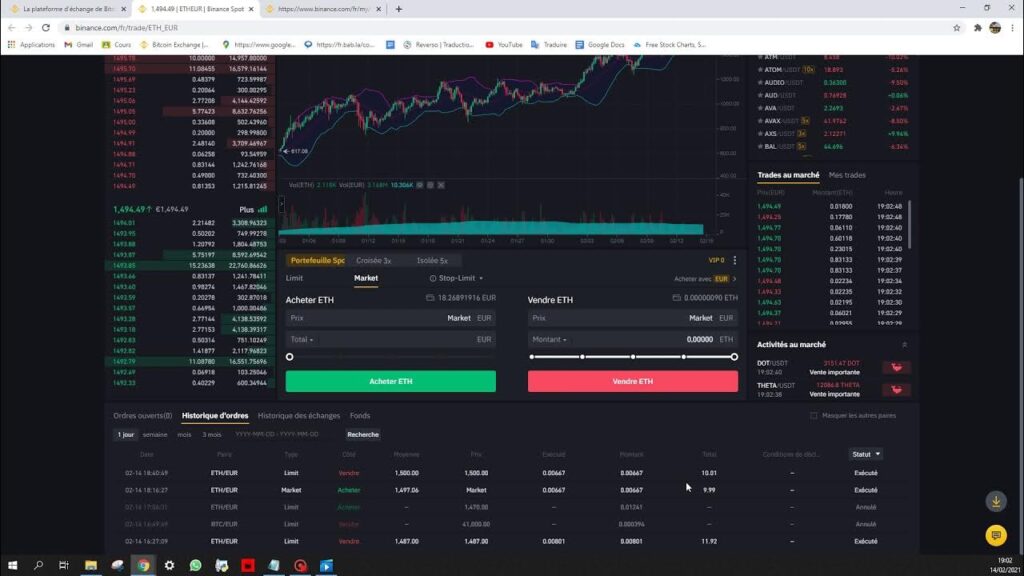

Choosing the Right Trading Platform

Choosing the right trading platform is crucial for your success. The ideal platform should be user-friendly, reliable, and equipped with essential tools for executing trades and analyzing the market. Some popular trading platforms include MetaTrader for forex, eToro for social trading, and Robinhood for commission-free stock trades.

Security is paramount when selecting a platform. Make sure the platform is regulated and offers security measures such as two-factor authentication. Additionally, consider the fees associated with trading on the platform, as these can affect your profitability in the long run.

Setting Up a Trading Account

Before you start trading, you’ll need to set up a trading account. The most common types of accounts include cash accounts, margin accounts, and demo accounts. A cash account allows you to trade only with the money you deposit, while a margin account lets you borrow funds to trade larger positions. A demo account, on the other hand, allows you to practice without risking real money.

The process of registering and verifying your account varies depending on the platform. Typically, you’ll need to provide identification and proof of residence to comply with anti-money laundering (AML) regulations. Once your account is verified, you can fund it via bank transfer, credit card, or e-wallet.

Understanding Market Orders

There are various types of market orders you can place when trading. The three most common are market orders, limit orders, and stop-loss orders. A market order is executed immediately at the current market price, while a limit order sets a specific price at which you’d like to buy or sell. A stop-loss order is used to limit potential losses by automatically selling a position if the price falls to a certain level.

Advanced order types, such as trailing stops and bracket orders, can help you manage risk more effectively. Knowing when and how to use each order type is essential for maximizing profits and minimizing losses.

Risk Management Strategies

Risk management is one of the most important aspects of trading. Without it, even the best trading strategy can lead to significant losses. One fundamental principle is diversification, which involves spreading your investments across various assets to reduce risk.

Using stop-loss and take-profit strategies can help you control your exposure to market movements. A stop-loss order automatically closes a position if the price falls to a certain level, protecting you from further losses. A take-profit order ensures that you lock in gains when the price reaches a specified target.

Analyzing Market Data

Successful trading depends heavily on your ability to analyze market data. There are three main types of analysis: technical, fundamental, and sentiment. Technical analysis involves studying price charts and identifying patterns or trends. Popular indicators include moving averages, Bollinger Bands, and the Relative Strength Index (RSI).

Fundamental analysis focuses on evaluating the financial health of companies, the economy, or news events that could impact market conditions. Lastly, sentiment analysis involves gauging the mood of the market participants to predict future price movements.

Developing a Trading Strategy

There are several types of trading strategies you can adopt, ranging from scalping, which involves quick, small trades, to position trading, which focuses on long-term market movements. Day trading and swing trading fall somewhere in between, with trades lasting from a few hours to a few days.

Creating a personalized trading plan is essential for consistency. A trading plan should outline your strategy, risk tolerance, goals, and criteria for entering and exiting trades. Once you have a plan, backtesting it on historical data is a good way to evaluate its effectiveness.

Introduction to Leverage

Leverage allows you to trade with more capital than you have in your account by borrowing funds from the broker. While it can amplify profits, it also increases the risk of losses. For example, a 10:1 leverage ratio means that for every $1 you invest, you control $10 worth of assets.

Calculating leverage and margin requirements is critical to ensuring you don’t overextend yourself. Each broker sets specific margin requirements based on the type of assets being traded.

Trading Psychology

Your emotional state can greatly impact your trading decisions. Fear, greed, and impatience are common emotions that can lead to poor judgment. Developing a disciplined mindset is crucial to staying focused on your long-term trading goals.

Common psychological pitfalls include overtrading, chasing losses, and holding onto losing trades for too long. Establishing rules for yourself and sticking to them can help you overcome these challenges.

Advanced Trading Strategies

As you advance in your trading journey, you can explore more sophisticated strategies such as hedging, arbitrage, and options trading. Hedging involves taking an opposite position in the market to reduce risk, while arbitrage takes advantage of price differences between markets. Options and futures contracts offer additional flexibility for speculating on price movements or hedging against risks.

Advanced traders often use technical indicators like Fibonacci retracement, moving averages, and Bollinger Bands to refine their strategies and increase their chances of success.

Using Trading Tools and Software

Trading tools such as bots and automated systems can help you execute trades more efficiently. Bots can be programmed to follow specific strategies and can operate around the clock, taking advantage of market opportunities even when you’re not actively monitoring the markets.

Charting tools like TradingView and MetaTrader provide powerful visualization options to help you spot trends, while trading signals can alert you to potential market opportunities.

Continuous Learning and Improvement

Trading is a continuous learning process. Keeping a trading journal can help you track your performance and identify areas for improvement. Learning from your mistakes and adapting your strategies is key to long-term success.

Staying updated with the latest market news and trends will also help you stay ahead of the curve. Many professional traders participate in webinars, read trading books, and follow financial news to enhance their skills.

Conclusion and Final Tips

Starting your trading journey can seem overwhelming, but by mastering the basics and continuously refining your skills, you can progress from beginner to advanced levels. Trading is a lifelong learning process, and success comes from a combination of education, discipline, and practical experience. Remember to manage your risks, keep your emotions in check, and remain open to learning from both your successes and failures.

FAQ’s

What are the best times to trade?

The best times to trade depend on the asset class you’re trading. For stocks, the opening and closing hours of the market tend to be the most volatile, offering the greatest opportunities. For forex, major market overlaps, such as between London and New York, provide the highest liquidity.

How much capital do I need to start trading?

The amount of capital needed varies depending on the asset you’re trading. Some brokers allow you to start with as little as $100, while others may require a minimum deposit of $1,000 or more. However, it’s important to only trade with money you can afford to lose.

What are the biggest risks in trading?

The biggest risks include market volatility, leverage-induced losses, and emotional trading. To mitigate these risks, it’s important to use risk management strategies such as setting stop-loss orders and diversifying your portfolio.

Can I trade part-time?

Yes, many traders start part-time while keeping their regular jobs. Swing trading and position trading are suitable for part-time traders because they don’t require constant monitoring of the markets.

How long does it take to become a successful trader?

The timeline varies for each individual. It can take anywhere from several months to a few years to become consistently profitable, depending on your dedication, learning curve, and ability to manage risk.

Do I need a mentor or professional guidance to start trading?

While having a mentor can accelerate your learning, it’s not absolutely necessary. There are many free and paid resources available online, including webinars, courses, and forums, where you can learn from experienced traders.

What is one example of trading?

Henry has food but needs wool whereas Liam has wool but needs food. So Liam and Henry will exchange food and wool with each other so that Liam gets food and Henry gets wool making both of them satisfied. This is a perfect example of trade.